UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

Zeta Global Holdings Corp.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

ZETA GLOBAL HOLDINGS CORP.

3 Park Ave. 33rd Floor

New York, NY 10016

NOTICE & PROXY STATEMENT

20232024 Annual Meeting of Stockholders

June 9, 202318, 2024

1:00 p.m. (Eastern time)

April 27, 202326, 2024

To Our Stockholders:

You are cordially invited to attend the 20232024 Annual Meeting of Stockholders (the “Annual Meeting”) of Zeta Global Holdings Corp. at 1:00 p.m. Eastern time, on Friday,Tuesday, June 9, 202318, 2024 at the offices of Latham & Watkins LLP, 1271 Avenue of the Americas, New York, NY 10020.

The Notice of Meeting and Proxy Statement on the following pages describe the matters to be presented at the Annual Meeting. Please see the section called “Who can attend the Annual Meeting?” on page 4 of the proxy statement for more information about how to attend the meeting.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted at the Annual Meeting. Therefore, I urge you to promptly vote and submit your proxy by phone, via the Internet, or, if you received paper copies of these materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope, which requires no postage if mailed in the United States. If you have previously received our Notice of Internet Availability of Proxy Materials, then instructions regarding how you can vote are contained in that notice. If you have received a proxy card, then instructions regarding how you can vote are contained on the proxy card. If you decide to attend the Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy. In such case, your previously submitted proxy will be disregarded.

Thank you for your support.

Sincerely,

David Steinberg

Chief Executive Officer and Co-Founder

Table of Contents

Page

ZETA GLOBAL HOLDINGS CORP.

3 Park Ave. 33rd Floor

New York, NY 10016

Notice of Annual Meeting of Stockholders

TO BE HELD ON FRIDAY,TUESDAY, JUNE 9, 202318, 2024

The Annual Meeting of Stockholders (the “Annual Meeting”) of Zeta Global Holdings Corp., a Delaware corporation (the “Company”), will be held at 1:00 p.m. Eastern time on Friday,Tuesday, June 9, 202318, 2024 at the offices of Latham & Watkins LLP, 1271 Avenue of the Americas, New York, NY 10020. The Annual Meeting will be held for the following purposes:

Holders of record of our common stock as of the close of business on April 17, 202329, 2024 are entitled to notice of and to vote at the Annual Meeting, or any continuation, postponement or adjournment of the Annual Meeting. The Annual Meeting may be continued, postponed or adjourned from time to time without notice other than by announcement at the Annual Meeting.

It is important that your shares be represented regardless of the number of shares you may hold. Whether or not you plan to attend the Annual Meeting, we urge you to vote your shares via the toll-free telephone number or over the Internet, as described in the enclosed materials. If you received a copy of the proxy card by mail, you may sign, date and mail the proxy card in the enclosed return envelope. Promptly voting your shares will ensure the presence of a quorum at the Annual Meeting and will save us the expense of further solicitation. Submitting your proxy now will not prevent you from voting your shares at the Annual Meeting if you desire to do so, as your proxy is revocable at your option.

By Order of the Board of Directors,

/s/ Steven Vine

Steven Vine

General Counsel and Secretary

New York, NY

April 27, 202326, 2024

i

ZETA GLOBAL HOLDINGS CORP.

3 Park Ave. 33rd Floor

New York, NY 10016

PROXY STATEMENT

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Zeta Global Holdings Corp. (the “Company”) of proxies to be voted at our Annual Meeting of Stockholders to be held on Friday,Tuesday, June 9, 202318, 2024 (the “Annual Meeting”), at 1:00 p.m. Eastern time, and at any continuation, postponement, or adjournment of the Annual Meeting.

Holders of record of shares of our Class A common stock, par value $0.001 per share (the “Class A Stock”), and our Class B common stock, par value $0.001 per share (the “Class B Stock,” and together with our Class A Stock, the “Common Stock”), as of the close of business on April 17, 202329, 2024 (the “Record Date”), will be entitled to notice of and to vote at the Annual Meeting and any continuation, postponement, or adjournment of the Annual Meeting. As of the Record Date, we expect that there were 176,197,888will be 189,736,589 shares of Class A Stock and 31,723,37929,055,489 shares of Class B Stock outstanding and entitled to vote at the Annual Meeting. Each share of Class A Stock is entitled to one vote per share and each share of Class B Stock is entitled to 10 votes per share on any matter presented to stockholders at the Annual Meeting. The holders of Class A Stock and Class B Stock will vote together as a single class on all matters to be presented to stockholders at the Annual Meeting.

On or about April 27, 2023,May 3, 2024, we beganwill begin to mail to our Stockholders of record as of the close of business on the Record Date a full set of proxy materials (including the notice of annual meeting of stockholders, this proxy statement, annual report and proxy card) or a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and the Company’s Annual Report to Stockholders for the year ended December 31, 20222023 (the “2022“2023 Annual Report”) and vote online.

In this proxy statement, “Zeta”, “Company”, “we”, “us”, and “our” refer to Zeta Global Holdings Corp.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON FridayTuesday, June 18, JUNE 9, 20232024

This Proxy Statement and our 20222023 Annual Report to Stockholders are available at www.edocumentview.com/ZETA

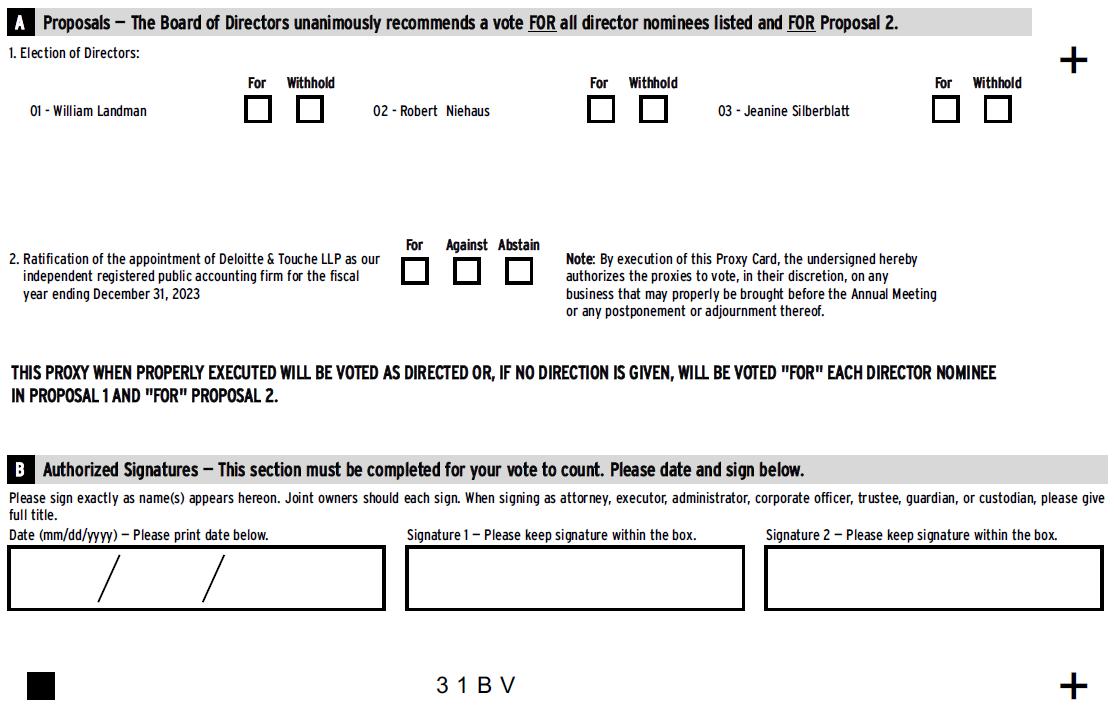

Proposals

At the Annual Meeting, our stockholders will be asked:

1

1

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Recommendations of the Board

The Board recommends that you vote your shares as indicated below. If you return a properly completed proxy card, or vote your shares by telephone or Internet, your shares of Common Stock will be voted on your behalf as you direct. If not otherwise specified, the shares of Common Stock represented by the proxies will be voted by the proxies in accordance with the recommendations of the Board, and the Board recommends that you vote:

If any other matter properly comes before the stockholders for a vote at the Annual Meeting, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Information About This Proxy Statement

Why you received this proxy statement. You are viewing or have received these proxy materials because the Board is soliciting your proxy to vote your shares at the Annual Meeting. This proxy statement includes information that we are required to provide to you under the rules of the U.S. Securities and Exchange Commission (“SEC”) and that is designed to assist you in voting your shares.

Notice of Internet Availability of Proxy Materials. As permitted by SEC rules, Zeta is making this proxy statement and its 20222023 Annual Report available to its stockholders electronically via the Internet. On or about April 27, 2023,May 3, 2024, we mailedwill mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Internet Notice”) containing instructions on how to access this proxy statement and our 20222023 Annual Report and vote online. If you received an Internet Notice by mail, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Internet Notice instructs you on how to access and review all of the important information contained in the proxy statement and 20222023 Annual Report. The Internet Notice also instructs you on how you may submit your proxy over the Internet or phone, or how to request a paper proxy card. If you received an Internet Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials contained on the Internet Notice.

Printed Copies of Our Proxy Materials. If you received printed copies of our proxy materials, then instructions regarding how you can vote are contained on the proxy card included in the materials.

Householding. The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for Notices of Internet Availability of Proxy Materials or other Annual Meeting materials with respect to two or more stockholders sharing the same address by delivering a single Notice of Internet Availability of Proxy Materials or single set of the proxy materials addressed to those stockholders. This process, which is

2

commonly referred to as “householding,” potentially means extra convenience for stockholders and cost savings for companies.

To take advantage of this opportunity, we have delivered only one copy of the Internet Notice and, if applicable, one set of proxy materials to multiple stockholders who share an address, unless we received contrary instructions from the impacted stockholders prior to the mailing date. We agree to deliver promptly, upon written or oral request, a separate set of proxy materials, as requested, to any stockholder at a shared address to which a single set of those documents was delivered. If you prefer to receive separate copies of the proxy materials, please submit your request by writing to: Zeta Global Holdings Corp., Attn: Secretary, 3 Park Ave, 33rd Floor, New York, NY 10016 or by or by calling our Secretary at (212) 967-5055.

This year, a number of brokers with account holders who are our stockholders will likely be “householding” our proxy materials. A single Notice of Internet Availability of Proxy Materials or single set of the proxy materials will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be “householding” communications to your address, “householding” will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in “householding” and would prefer to receive a separate Notice of Internet Availability of Proxy Materials or full set of proxy materials, please notify your broker. Stockholders who currently receive multiple copies of the Notice of Internet Availability of Proxy Materials or the

2

full set of proxy materials at their addresses and would like to request “householding” of their communications should contact their brokers.

3

3

Who is entitled to vote at the Annual Meeting?

The Record Date for the Annual Meeting is April 17, 2023.29, 2024. You arewill be entitled to vote at the Annual Meeting only if you were a holder of record of Class A Stock or Class B Stock at the close of business on that date, or if you hold a valid proxy for the Annual Meeting. Each outstanding share of Class A Stock is entitled to one vote per share and each outstanding share of Class B Stock is entitled to 10 votes per share on all matters presented at the Annual Meeting. The holders of Class A Stock and Class B Stock will vote together as a single class on all matters presented to stockholders at the Annual Meeting. At the close of business onOn the Record Date, we expect there were 176,197,888will be 189,736,589 shares of Class A Stock and 31,723,37929,055,489 shares of Class B Stock outstanding and entitled to vote at the Annual Meeting, representing 36%39.5% and 64%60.5% voting power of our Common Stock, respectively.

What is the difference between being a “record holder” and holding shares in “street name”?

A record holder holds shares in his or her name. Shares held in “street name” means shares that are held in the name of a bank or broker on a person’s behalf.

Am I entitled to vote if my shares are held in “street name”?

Yes. If your shares are held by a bank or a brokerage firm, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, these proxy materials are being provided to you by your bank or brokerage firm, along with a voting instruction card if you received printed copies of our proxy materials. As the beneficial owner, you have the right to direct your bank or brokerage firm how to vote your shares, and the bank or brokerage firm is required to vote your shares in accordance with your instructions. If your shares are held in street name, you may not vote your shares in person at the Annual Meeting, unless you obtain a legal proxy from your bank or brokerage firm.

How many shares must be present to hold the Annual Meeting?

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting in person or by proxy, of the holders of a majority in voting power of the Common Stock issued and outstanding and entitled to vote on the Record Date will constitute a quorum.

Who can attend the Annual Meeting?

You may attend the Annual Meeting only if you are a Zeta stockholder who is entitled to vote at the Annual Meeting, or if you hold a valid proxy for the Annual Meeting. If you plan to attend the Annual Meeting, you must email the Company’s investor relations staff at ir@zetaglobal.com no later than 5:00 p.m. Eastern time on June 7, 202314, 2024 to have your name placed on the attendance list. In order to be admitted into the Annual Meeting, your name must appear on the attendance list and you must present government-issued photo identification (such as a driver’s license). If your bank or broker holds your shares in street name, you will also be required to present proof of beneficial ownership of our common stockCommon Stock on the Record Date, such as the Internet Notice you received from your bank or broker, a bank or brokerage statement, or a letter from your bank or broker showing that you owned shares of our common stockCommon Stock at the close of business on the Record Date.

What if a quorum is not present at the Annual Meeting?

If a quorum is not present at the scheduled time of the Annual Meeting, then either the Chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the meeting, present in person or by proxy, is authorized by our Amended and Restated Bylaws to recess or adjourn the meeting. At any recessed or adjourned meeting at which a quorum is present or represented, any business may be transacted that might have been transacted at the meeting as originally noticed.

What does it mean if I receive more than one Internet Notice or more than one set of proxy materials?

It means that your shares are held in more than one account at the transfer agent and/or with banks or brokers. Please vote all of your shares. To ensure that all of your shares are voted, for each Internet Notice or set of proxy materials,

4

4

please submit your proxy by phone, via the Internet, or, if you received printed copies of the proxy materials, by signing, dating and returning the enclosed proxy card in the enclosed envelope.

How do I vote?

Stockholders of Record. If you are a stockholder of record, you may vote:

Internet and telephone voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m., Eastern time, on June 8, 2023.17, 2024. To vote via the Internet or telephone, you will need the control number included on your Internet Notice, on your proxy card or on the instructions that accompanied your proxy materials.

Whether or not you expect to attend the Annual Meeting, we urge you to vote your shares as promptly as possible to ensure your representation and the presence of a quorum at the Annual Meeting. If you submit your proxy, you may still decide to attend the Annual Meeting and vote your shares.

Beneficial Owners of Shares Held in “Street Name.” If your shares are held in “street name” through a bank or broker, you will receive instructions on how to vote from the bank or broker. You must follow their instructions in order for your shares to be voted. Internet and telephone voting also may be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you would like to vote your shares in person at the Annual Meeting, you should contact your bank or broker to obtain a legal proxy and bring it to the Annual Meeting in order to vote.

Can I change my vote after I submit my proxy?

Yes.

If you are a registered stockholder, you may revoke your proxy and change your vote:

Your most recent proxy card or Internet or telephone proxy is the one that is counted. Your attendance at the Annual Meeting by itself will not revoke your proxy unless you vote in person at the Annual Meeting.

If your shares are held in street name, you may change or revoke your voting instructions by following the specific directions provided to you by your bank or broker, or you may vote in person at the Annual Meeting by obtaining a legal proxy from your bank or broker and submitting the legal proxy along with your ballot.

5

5

Who will count the votes?

A representative of Computershare, our inspector of election, will tabulate and certify the votes.

What if I do not specify how my shares are to be voted?

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote in accordance with the recommendations of the Board. The Board’s recommendations are indicated on page 2 of this proxy statement, as well as with the description of each proposal in this proxy statement.

Will any other business be conducted at the Annual Meeting?

We know of no other business that will be presented at the Annual Meeting. If any other matter properly comes before the stockholders for a vote at the Annual Meeting, however, the proxy holders named on the Company’s proxy card will vote your shares in accordance with their best judgment.

Will there be a question and answer session during the Annual Meeting?

As part of the Annual Meeting, we will hold a Q&A session, during which we intend to answer questions that are pertinent to the Company and the meeting matters, as time permits. Only stockholders that attend the Annual Meeting will be permitted to ask questions during the Annual Meeting. Each stockholder is limited to no more than two questions. Questions should be succinct and only cover a single topic. We will not address questions that are, among other things:

How many votes are required for the approval of the proposals to be voted upon and how will withholds, abstentions and broker non-votes be treated?

6

Proposal | Votes required | Effect of Votes Withheld / Abstentions and Broker Non-Votes |

Proposal 1: Election of Directors | A plurality of the votes cast. This means that the three (3) nominees receiving the highest number of affirmative “FOR” votes will be elected as Class | Votes withheld and broker non-votes will have no effect. |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm | The affirmative vote of the holders of a majority in voting power of the votes cast. | Abstentions will have no effect. We do not expect any broker non-votes on this |

Proposal 3: Approval, on an advisory (non-binding) basis, of the compensation of our named executive officers | The affirmative vote of the holders of a majority in voting power of the votes cast. | Abstentions and broker non-votes will have no effect. |

Proposal 4: Approval, on an advisory (non-binding) basis, of the frequency of future advisory votes on the compensation of our named executive officers | The affirmative vote of the holders of a majority in voting power of the votes cast.* | Abstentions and broker non-votes will have no effect. |

* If no frequency receives the majority of votes cast, then we will consider the option receiving the highest number of votes cast by stockholders as the advisory vote of our stockholders.

6

What is a “vote withheld” and an “abstention” and how will votes withheld and abstentions be treated?

A “vote withheld,” in the case of the proposal regarding the election of directors, or an “abstention,” in the case of the proposal regardingthree other proposals to be voted on at the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm,Annual Meeting, represents a stockholder’s affirmative choice to decline to vote on a proposal. Votes withheld and abstentions are counted as present and entitled to vote for purposes of determining a quorum. Votes withheld have no effect on the election of directors and abstentions have no effect on the ratification of the appointment of Deloitte & Touche LLP.LLP or the approvals, each on an advisory (non-binding) basis, of the compensation of our named executive officers or of the frequency of future advisory votes on the compensation of our named executive officers.

What are broker non-votes and do they count for determining a quorum?

Generally, broker non-votes occur when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a particular proposal because the broker (1) has not received voting instructions from the beneficial owner and (2) lacks discretionary voting power to vote those shares. A broker is entitled to vote shares held for a beneficial owner on routine matters, such as the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm, without instructions from the beneficial owner of those shares. On the other hand, absent instructions from the beneficial owner of such shares, a broker is not entitled to vote shares held for a beneficial owner on non-routine matters, such as the election of directors.directors and the approvals, each on an advisory (non-binding) basis, of the compensation of our named executive officers or of the frequency of future advisory votes on the compensation of our named executive officers. Broker non-votes count for purposes of determining whether a quorum is present.

Where can I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting and we will report the final results in a Current Report on Form 8-K, which we intend to file with the SEC within four business days of the date of the Annual Meeting.

7

7

Proposal 1: Election of Directors

At the Annual Meeting, three (3) Class IIIII directors are to be elected to hold office until the Annual Meeting of Stockholders to be held in 20262027 and until each such director’s respective successor is elected and qualified or until each such director’s earlier death, resignation or removal.

Our current Class III Directors are David Steinberg and John Sculley. The Board has nominated each of our Class III incumbent directors, David Steinberg and John Sculley, to serve as Class III directors until the 2027 Annual Meeting. The Board has also nominated a new director, Imran Khan, to serve as a Class III director until the 2027 Annual Meeting. We currently have seven (7) directors on our Board. Our current Class II DirectorsBoard, which will increase to eight (8) directors if all three (3) director nominees are William Landman, Robert Niehaus and Jeanine Silberblatt. The Board has nominated each of the foregoing director candidates to serveelected as Class IIIII directors untilat the 2026 Annual Meeting.

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three (3) nominees receiving the highest number of affirmative “FOR” votes will be elected as Class IIIII directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

In accordance with our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws, our Board is divided into three classes with staggered three-year terms. At each annual meeting of stockholders, the successors to the directors whose terms will then expire will be elected to serve from the time of election and qualification until the third annual meeting following their election. The current class structure is as follows: Class I, whose term will expire at the 2025 Annual Meeting of Stockholders; Class II, whose term will expire at the 2026 Annual Meeting of Stockholders; and Class III, whose current term will expire at the Annual Meeting, and, if elected at the Annual Meeting, whose subsequent term will expire at the 2026 Annual Meeting of Stockholders; and Class III, whose term will expire at the 20242027 Annual Meeting of Stockholders. The current Class I Directors are William Royan and Jené Elzie; the current Class II Directors are William Landman, Robert Niehaus and Jeanine Silberblatt; and the current Class III Directors are David Steinberg and John Sculley.

Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that, subject to the rights of holders of any series of preferred stock, the authorized number of directors may be changed from time to time by the Board. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. Prior to the date as of which the holders of Class B Common Stock no longer hold at least a majority of the voting power of the outstanding shares of common stockCommon Stock (the “Sunset Date”), and subject to the rights of the holders of any series of preferred stock then outstanding in respect of preferred stock directors, any director or the entire Board may only be removed with or without cause by the affirmative vote of the holders of a majority in voting power of our common stockCommon Stock then entitled to vote at an election of directors. After the Sunset Date, any director or the entire Board may be removed only for cause and only by the affirmative vote of the holders of a majority in voting power of our common stockCommon Stock then entitled to vote at an election of directors.

If you submit a proxy but do not indicate any voting instructions, the persons named as proxies will vote the shares of Common Stock represented by the proxy for the election as Class II DirectorsIII directors the persons whose names and biographies appear below. AllOther than Imran Khan, all of the persons whose names and biographies appear below are currently serving as our directors. In the event that any of William Landman, Robert NiehausDavid Steinberg, John Sculley and Jeanine SilberblattImran Khan should become unable to serve, or for good cause will not serve, as a director, it is intended that votes will be cast for a substitute nominee designated by the Board or the Board may elect to reduce its size. The Board has no reason to believe that any of the director nominees will be unable to serve if elected. Each of the director nominees has consented to being named in this proxy statement and to serve if elected. If all three nominees are elected as Class III directors at the Annual Meeting, the Board will increase its size from seven (7) directors to eight (8) directors.

Vote required

The proposal regarding the election of directors requires the approval of a plurality of the votes cast. This means that the three (3) nominees receiving the highest number of affirmative “FOR” votes will be elected as Class II Directors.III directors. Votes withheld and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

8

8

The Board unanimously recommends a vote FOR the election of each of the below Class II DirectorIII director nominees.

Nominees For Class IIIII Director (terms to expire at the 20262027 Annual Meeting)

The current members of the Board who are also nominees for election to the Board as Class III Directors are as follows:

Name | Age | Served as a Director Since | Position with Zeta |

William Landman | 70 | 2008 | Director |

Robert Niehaus | 67 | 2012 | Director |

Jeanine Silberblatt | 45 | 2022 | Director |

Name | Age | Served as a Director Since | Position with Zeta |

David Steinberg | 54 | 2007 | Chairman and Chief Executive Officer |

John Sculley | 85 | 2008 | Director (Vice Chairman) |

Imran Khan | 46 | N/A | Director Nominee |

The principal occupations and business experience, for at least the past five years, of each Class IIIII Director nominee for election at the Annual Meeting are as follows:

David Steinberg

David Steinberg has been a member of our Board since 2007 and is the Co-founder, Chairman and Chief Executive Officer of Zeta. Mr. Steinberg is also Chairman of CAIVIS Investment Company, Kica Investments and On Demand Pharmaceuticals. Previously, he was the founder and Chief Executive Officer of InPhonic, a seller of wireless phones and communications products and services. Prior to that he was the Chairman and Chief Executive Officer of Sterling Cellular. He holds a BA in Economics from Washington & Jefferson College.

We believe that Mr. Steinberg is qualified to serve on our Board due to his marketing and entrepreneurial background.

John Sculley

John Sculley has served on our Board since 2008 and is the Co-founder and Vice Chairman of Zeta. Since leaving his role of CEO at Apple Computer, Inc. in 1993, Mr. Sculley has focused on investing in early-stage companies as a venture capitalist and co-founder of several companies. He holds a BA from Brown University and an MBA from the Wharton School at the University of Pennsylvania.

We believe Mr. Sculley is qualified to serve on our Board due to the expertise he brings in marketing and company leadership.

Imran Khan

Imran Khan is the founder and has served as Chief Investment Officer of Proem Asset Management, an investment firm that focuses on the technology space, since 2019. Additionally, Imran co-founded and is currently chairman of Verishop, an eCommerce enablement company that empowers independent and emerging brands. In addition to Verishop, Imran is also a member of the board of directors at Dave Inc. Prior to co-founding Proem Asset Management, Imran served as Snap Inc.’s Chief Strategy Officer, where he oversaw the company’s corporate strategy, revenue generation, business operations and partnerships. Previously, Imran was a Managing Director and Head of Global Internet Investment Banking at Credit Suisse. Before joining Credit Suisse, Imran held the role of Managing Director and Head of Global Internet Research at JPMorgan Chase. Imran holds a Bachelor of Science in Business Administration (B.S.B.A.) in Finance and Economics from the University of Denver.

We believe Mr. Khan is qualified to serve on our Board due to his longstanding experience in investment and company management.

Continuing members of the Board of Directors:

Class I Directors (terms to expire at the 2025 Annual Meeting)

The current members of the Board who are Class I Directors are as follows:

9

Name | Age | Served as a Director Since | Position with Zeta |

William Royan | 55 | 2017 | Director |

Jené Elzie | 49 | 2021 | Director |

William Royan

William Royanhas served on our Board since 2017. He is the Managing Partner and Chair of the Investment Committee of GPI Capital, an alternative investment firm. Previously, he was a member of the Global Management Committee and Chief Investment Officer of a predecessor fund of BTG Pactual, a global financial services firm. Mr. Royan has been a director of numerous public and private companies, including the TMX Group, a Canadian financial services company that operates various market exchanges, where he chaired its Governance Committee, and BTG Pactual, a financial company offering investment banking, as well as wealth and asset management services. He holds a Bachelor of Commerce from the University of Calgary and an MBA from the University of Chicago.

We believe Mr. Royan is qualified to serve on our Board because of his background in financial services.

Jené Elzie

Jené Elzie has served on our Board since 2021. She has over three decades of experience as a sports and entertainment executive, having worked for and with some of the most respected global brands in the industry, including NBA, Golf Channel, Comcast/NBCUniversal, and Fox Sports. She has served as Managing Director, Investment Team at Dunes Point Capital, a private equity firm, since 2023 and as President of Seven Springs Global Advisors, a business transformation advisory firm, since 2022. From 2018 to 2022, Ms. Elzie served as Chief Growth Officer for Athletes First Partners, a sports marketing agency representing sports properties, including the National Basketball Players Association, the National Basketball Retired Players Association, and the US Olympic & Paralympic Committee. She also serves on the board of Varsity Brands, Inc. and Invited (ClubCorp.) From 2013 to 2018, she served as Vice President, International Marketing at the National Basketball Association. Ms. Elzie holds a bachelor’s degree in economics and a master’s degree in sociology, both from Stanford University.

We believe Ms. Elzie is qualified to serve on our Board because of her extensive experience as an executive in the marketing, sports and entertainment industries.

Class II Directors (terms to expire at the 2026 Annual Meeting)

The current members of the Board who are Class II Directors are as follows:

Name | Age | Served as a Director Since | Position with Zeta |

William Landman | 71 | 2008 | Director |

Robert Niehaus | 68 | 2012 | Director |

Jeanine Silberblatt | 46 | 2022 | Director |

William Landman

William Landmanhas served on our Board since 2008. Mr. Landman is the Co-founder and Managing Principal of MainLine Investment Partners, LLC, where he directs the investment activities, management and strategic initiatives of the company and its affiliates, MainLine Private Wealth and Merion Realty Partners. Since 1987, Mr. Landman has also been a Principal and Senior Managing Director of CMS Companies, an alternative investments firm. Further, he is a Senior Advisor at Renovus Capital, an education-oriented small business investment company, and is a Principal and Manager of Merion Residential, a real estate management company. He holds a BA from the University of Pittsburgh and a JD from the University of Pittsburgh School of Law.

We believe that Mr. Landman is qualified to serve on our Board due to his longstanding experience in investmentsinvestment and company management.

10

Robert Niehaus

Robert Niehaushas served on our Board since 2012 and has over 30 years of experience in investment and private equity. Mr. Niehaus is the Chairman and Founder of GCP Capital Partners LLC (“GCP”) and has served as Chairman of GCP and its predecessor business Greenhill Capital Partners and their respective Investment Committees since 2000. In addition, Mr. Niehaus is Chairman of Iridium Communications Inc., a satellite communications company, and previously served as a Director for Heartland Payment Systems, a payments technology business. He holds a BA in international affairs from Princeton University and an MBA from Harvard Business School.

We believe Mr. Niehaus is qualified to serve on our Board due to his extensive corporate governance and investment strategy experience.

Jeanine Silberblatt

Jeanine Silberblatt has served on our Board since 2022. She has over 20 years of experience across retail, tech and finance, having worked for or with large omnichannel retailers, direct-to-consumer brands, AI-enabled business models and financial services firms. She most recently served as Vice President, eCommerce & Digital Marketing, at Pottery Barn Teen at Williams-Sonoma, Inc. from 2020 to 2023. From 2017 to 2020, she was the Vice President/General Manager, Merchandising & Brand Partnerships at Stockwell AI Inc. She is also a Founding Member of Chief, a private network designed for senior women leaders to strengthen their leadership journey, cross-pollinate ideas across industries, and effect change from the top-down. She also serves on the board of Fashion Incubator San Francisco (FiSF), a non-profit incubator committed to turning fashion apparel designers into successful San Francisco entrepreneurs and employers. Ms. Silberblatt holds a Bachelor of Science from Delaware State University and an MBA from Harvard Business School.

We believe Ms. Silberblatt is qualified to serve on our Board due to her experience as an executive in marketing.

9

The current members of the Board who are Class I Directors are as follows:

Name | Age | Served as a Director Since | Position with Zeta |

William Royan | 55 | 2017 | Director |

Jené Elzie | 49 | 2021 | Director |

William Royanhas served on our Board since 2017. He is the Managing Partner and Chair of the Investment Committee of GPI Capital, an alternative investment firm. Previously, he was a member of the Global Management Committee and Chief Investment Officer of a predecessor fund of BTG Pactual, a global financial services firm. Mr. Royan has been a director of numerous public and private companies, including the TMX Group, a Canadian financial services company that operates various market exchanges, where he chaired its Governance Committee, and BTG Pactual, a financial company offering investment banking, as well as wealth and asset management services. He holds a Bachelor of Commerce from the University of Calgary and an MBA from the University of Chicago.

We believe Mr. Royan is qualified to serve on our Board because of his background in financial services.

Jené Elzie has served on our Board since 2021. She has over three decades of experience as a sports and entertainment executive, having worked for and with some of the most respected global brands in the industry, including NBA, Golf Channel, Comcast/NBCUniversal, and Fox Sports. She currently serves as President of Seven Springs Global Advisors, a business transformation advisory firm. From 2018 to 2022, Ms. Elzie served as Chief Growth Officer for Athletes First Partners, a sports marketing agency representing sports properties, including the National Basketball Players Association, the National Basketball Retired Players Association, and the US Olympic & Paralympic Committee. She also serves on the board of Varsity Brands, Inc. and Invited (formerly ClubCorp.). From 2013 to 2018, she served as Vice President, International Marketing at the National Basketball Association. Ms. Elzie holds a bachelor’s degree in economics and a master’s degree in sociology, both from Stanford University.

We believe Ms. Elzie is qualified to serve on our Board because of her extensive experience as an executive in the marketing, sports and entertainment industries.

The current members of the Board who are Class III Directors are as follows:

Name | Age | Served as a Director Since | Position with Zeta |

David Steinberg | 53 | 2007 | Chairman and Chief Executive Officer |

John Sculley | 84 | 2008 | Director |

David Steinberg has been a member of our Board since 2007 and is the Co-founder, Chairman and Chief Executive Officer of Zeta. Mr. Steinberg is also Chairman of CAIVIS Investment Company, Kica Investments and On Demand Pharmaceuticals. Previously, he was the founder and Chief Executive Officer of InPhonic, a seller of wireless phones and communications products and services. Prior to that he was the Chairman and Chief Executive Officer of Sterling Cellular. He holds a BA in Economics from Washington & Jefferson College.

10

We believe that Mr. Steinberg is qualified to serve on our Board due to his marketing and entrepreneurial background.

John Sculley has served on our Board since 2008 and is the Co-founder and Vice Chairman of Zeta. Since leaving his role of CEO at Apple Computer, Inc. in 1993, Mr. Sculley has focused on investing in early-stage companies as a venture capitalist and co-founder of several companies. He holds a BA from Brown University and an MBA from the Wharton School at the University of Pennsylvania.

We believe Mr. Sculley is qualified to serve on our Board due to the expertise he brings in marketing and company leadership.

Our Audit Committee has appointed Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2023.2024. Our Board has directed that this appointment be submitted to our stockholders for ratification at the Annual Meeting. Although ratification of our appointment of Deloitte & Touche LLP is not required, we value the opinions of our stockholders and believe that stockholder ratification of our appointment is a good corporate governance practice.

Deloitte & Touche LLP also served as our independent registered public accounting firm for the fiscal year ended December 31, 2022.2023. Neither the accounting firm nor any of its members has any direct or indirect financial interest in or any connection with us in any capacity other than as our auditors, providing audit and non-audit services. A representative of Deloitte & Touche LLP is expected to attend the Annual Meeting and to have an opportunity to make a statement if he or she desires to do so, and be available to respond to appropriate questions from stockholders.

In the event that the appointment of Deloitte & Touche LLP is not ratified by the stockholders, the Audit Committee will consider this fact when it appoints the independent auditors for the fiscal year ending December 31, 2024.2025. Even if the appointment of Deloitte & Touche LLP is ratified, the Audit Committee retains the discretion to appoint a different independent auditor at any time if it determines that such a change is in the interest of the Company.

Vote Required

This proposal requires the affirmative vote of the holders of a majority in voting power of the votes cast. Abstentions are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal. Because brokers have discretionary authority to vote on the ratification of the appointment of Deloitte & Touche LLP, we do not expect any broker non-votes in connection with this proposal.

11

Recommendation of the Board of Directors

The Board unanimously recommends a vote FOR the ratification of the appointment of Deloitte & Touche LLP as our Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2023.2024.

Proposal 3: Approval, on an Advisory (Non-Binding) Basis, of the Compensation of Our Named Executive Officers

In accordance with the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) and Rule 14a-21 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), the Company requests that our stockholders cast a non-binding, advisory vote to approve the compensation of our named executive officers identified in the section titled “Compensation Discussion and Analysis” in this proxy statement, including the compensation tables and the accompanying narrative disclosure contained therein, in accordance with the SEC’s compensation disclosure rules. This proposal, commonly known as a “say-on-pay” proposal, gives our stockholders the opportunity to express their views on our named executive officers’ compensation. This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers and the philosophy, policies and practices described in this proxy statement.

11Accordingly, we ask our stockholders to vote FOR the following resolution at the Annual Meeting:

Table“RESOLVED, that the Company’s stockholders approve, on a non-binding advisory vote, the compensation of Contentsthe named executive officers, as disclosed in the Company’s Proxy Statement for the 2024 Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the compensation tables and narrative discussion.”

We believe that our compensation programs and policies for the year ended December 31, 2023 were an effective incentive for the achievement of our goals, aligned with stockholders’ interest and were worthy of stockholder support. Additional details concerning how we structure our compensation programs to meet the objectives of our compensation program are provided in the section titled “Compensation Discussion and Analysis” set forth below in this proxy statement.

This say-on-pay vote is advisory, and therefore will not be binding on the Company, our Board or the Compensation Committee. However, the Board and the Compensation Committee value the opinions of our stockholders and intend to take into account the outcome of the vote when considering future executive compensation decisions. The Board values constructive dialogue on executive compensation and other significant governance topics with our stockholders and encourages all stockholders to vote their shares on this important matter.

Vote Required

The approval, on an advisory (non-binding) basis, of the compensation of our named executive officers will require the affirmative vote of the holders of a majority in voting power of the votes cast at the Annual Meeting. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board of Directors

The Board unanimously recommends a vote FOR the approval, on an advisory (non-binding) basis, of the compensation of our named executive officers.

Proposal 4: Approval, on an Advisory (Non-Binding) Basis, of the Frequency of Future Advisory Votes on the Compensation of Our Named Executive Officers

In accordance with the Dodd-Frank Act and Rule 14a-21 under the Exchange Act, the Company requests that our stockholders cast a non-binding, advisory vote regarding the frequency with which we should include in future annual proxy statements a stockholder advisory vote (the “Say-on-Pay Vote”) to approve the compensation of our named executive officers. By voting on this proposal, stockholders may indicate whether they would prefer that the Company provide for the Say-on-Pay Vote at future annual meetings every one year, every two years or every three years. Stockholders may also abstain from the vote.

12

Our Board has determined that providing a Say-on-Pay Vote every year is the most appropriate alternative for the Company at this time. In formulating its recommendation, the Board determined that an annual advisory vote on named executive officer compensation will allow stockholders to provide their direct input on our compensation philosophy, policies and practices as disclosed in future proxy statements on a more timely and consistent basis than if the vote were held less frequently. Additionally, an annual advisory vote on executive compensation is consistent with our policy of seeking regular dialogue with our stockholders on corporate governance matters and our executive compensation philosophy, policies and practices. We understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this proposal.

This “Say-on-Frequency” vote is advisory, and therefore not binding on the Company, the Board or the Compensation Committee. However, the Board and the Compensation Committee value the opinions of our stockholders and intend to consider our stockholders’ views regarding how often they should have the opportunity to express their views on our executive compensation programs.

Stockholders of the Company will have the opportunity to specify one of four choices for this proposal on the proxy card: (1) one year; (2) two years; (3) three years; or (4) abstain. Stockholders are not voting to approve or disapprove the Board’s recommendation. Rather, stockholders are being asked to express their preference regarding the frequency of future advisory votes to approve executive compensation.

Vote Required

The frequency that receives the affirmative vote of the holders of a majority in voting power of the votes cast at the Annual Meeting will be the frequency recommended by stockholders. If no frequency receives the foregoing vote, then we will consider the option of ONE YEAR, TWO YEARS, or THREE YEARS that receives the highest number of votes cast to be the frequency recommended by stockholders. Abstentions and broker non-votes are not considered to be votes cast and, accordingly, will have no effect on the outcome of the vote on this proposal.

Recommendation of the Board of Directors

The Board unanimously recommends a vote of ONE YEAR regarding the non-binding frequency of future advisory votes on the compensation of our named executive officers.

13

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The audit committee reviews the Company’s financial reporting process on behalf of the Board. Management has the primary responsibility for the financial statements, the reporting process and maintaining an effective system of internal controls over financial reporting. The Company’s independent auditors are engaged to audit and express opinions on the conformity of the Company’s financial statements to United States generally accepted accounting principles.

In addition to fulfilling its oversight responsibilities as set forth in its charter and further described in the section titled “Committees of the Board,” the audit committee has done the following things:

Based on the reviews and discussions with management and Deloitte cited above, including the review of Deloitte’s disclosures and letter to the audit committee and review of the representations of management and the reports of Deloitte, the audit committee recommended to the Board that the Company’s audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 20222023 filed with the SEC.

Audit Committee of the Board of Directors

Robert Niehaus (Chair)

William Royan

William Landman

The foregoing report shall not be deemed incorporated by reference by any general statement incorporating by reference this Proxy Statement into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Securities Exchange Act of 1934, as amended (the “Exchange Act”), except to the extent that the Company specifically incorporates this information by reference, and shall not otherwise be deemed filed under the Securities Act or the Exchange Act.

14

12

The following table summarizes the fees of Deloitte & Touche LLP, our independent registered public accounting firm, billed to us for each of the last two fiscal years for audit services and billed to us in each of the last two fiscal years for other services:

Fee Category | 2022 | 2021 |

Audit Fees | $ 1,324,068 | $ 1,295,990 |

Audit Related Fees | — | 1,124,663 |

Tax Fees | — | — |

All Other Fees | 293,189 | — |

Total Fees | $ 1,617,257 | $ 2,420,653 |

Fee Category | 2023 | 2022 |

Audit Fees | $ 2,724,269 | $ 1,324,068 |

Audit Related Fees | — | — |

Tax Fees | — | — |

All Other Fees | — | 293,189 |

Total Fees | $ 2,724,269 | $ 1,617,257 |

Audit Fees

Audit fees for the fiscal years ended December 31, 20222023 and December 31, 20212022 include fees for professional services rendered for the audit of our annual consolidated financial statements and for reviews of our financial statements included in our Quarterly Reports on Form 10-Q.

Audit related fees for the fiscal year ended December 31, 2021 include fees for professional services provided in connection with our initial public offering incurred during the fiscal year ended December 31, 2021, including comfort letters, consents, and review of documents filed with the SEC and with our Registration Statement on Form S-8.

All other fees for the fiscal year ended December 31, 2022 include advisory services provided in connection with Company’s preparedness for 404(A) / 404(B) of the Sarbanes-Oxley Act.

Audit Committee Pre-Approval Policy and Procedures

The Audit Committee has adopted a policy (the “Pre-Approval Policy”) that sets forth the procedures and conditions pursuant to which audit and non-audit services proposed to be performed by the independent auditor may be pre-approved. The Pre-Approval Policy generally provides that we will not engage Deloitte & Touche LLP to render any audit, audit-related, tax or permissible non-audit service unless the service is either (i) explicitly approved by the Audit Committee (“specific pre-approval”) or (ii) entered into pursuant to the pre-approval policies and procedures described in the Pre-Approval Policy (“general pre-approval”). Unless a type of service to be provided by Deloitte & Touche LLP has received general pre-approval under the Pre-Approval Policy, it requires specific pre-approval by the Audit Committee or by a designated member of the Audit Committee to whom the committee has delegated the authority to grant pre-approvals. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require specific pre-approval. For both types of pre-approval, the Audit Committee will consider whether such services are consistent with the SEC’s rules on auditor independence. The Audit Committee will also consider whether the independent auditor is best positioned to provide the most effective and efficient service, for reasons such as its familiarity with the Company’s business, people, culture, accounting systems, risk profile and other factors, and whether the service might enhance the Company’s ability to manage or control risk or improve audit quality. All such factors will be considered as a whole, and no one factor should necessarily be determinative. The Audit Committee may, on a periodic basis, review and generally pre-approve the services (and related fee levels or budgeted amounts) that may be provided by Deloitte & Touche LLP without first obtaining specific pre-approval from the Audit Committee. The Audit Committee may revise the list of general pre-approved services from time to time, based on subsequent determinations. The Audit Committee pre‑approved all services performed since the pre‑approval policy was adopted.

15

13

The following table identifies our current executive officers:

Name | Age | Position |

David Steinberg (1) |

| Chairman and Chief Executive Officer |

Christopher Greiner (2) |

| Chief Financial Officer |

Steven Gerber (3) |

| President and Chief Operating Officer |

_____________________

|

|

|

|

|

|

14(1) See biography on page 9 of this proxy statement.

Table(2) Christopher Greiner has been the Chief Financial Officer of ContentsZeta since 2020. He has over 20 years of experience in the technology industry. Prior to joining Zeta, Mr. Greiner served as Chief Financial Officer of LivePerson Inc., an AI-powered conversational cloud provider, from 2018 through March 2020 and before that spent five years at Inovalon, a cloud-based healthcare and life sciences analytics company, first as Chief Product and Operations Officer and then as Chief Financial Officer. Mr. Greiner also held roles of increasing executive responsibility at IBM from 1999 until 2012 and Computer Sciences Corporation (“CSC”) from 2012 to 2013. He holds a BBA in Finance and Economics from Baylor University.

(3) Steven Gerber has been the President and Chief Operating Officer of Zeta since 2009. Mr. Gerber oversees the day-to-day management of the Company, including product development, business development, customer success and operations. He has more than 20 years of experience in data-driven digital technology. Previously, Mr. Gerber was a Senior Vice President at Tranzact LLC and held management positions at Bain & Company and Digitas LLC. He holds a BA from Northwestern University and an MBA from Columbia University.

16

CORPORATE GOVERNANCE General

Our Board has adopted Corporate Governance Guidelines, a Code of Ethics and Conduct, and charters for our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee to assist the Board in the exercise of its responsibilities and to serve as a framework for the effective governance of the Company. You can access our current committee charters, our Corporate Governance Guidelines, and our Code of Ethics and Conduct in the “Governance” section of the “Investors” page of our website located at www.investors.zetaglobal.com, or the Company will furnish a copy of such documents to any person, without charge, upon written request to our Secretary at our offices at 3 Park Ave, 33rd Floor, New York, NY 10016. The information on or accessed through our website is deemed not to be incorporated in or part of this proxy statement or any other document filed with or furnished to the SEC.

Board Composition

Our Board currently consists of seven members: David Steinberg, Jené Elzie, William Landman, Robert Niehaus, William Royan, John Sculley and Jeanine Silberblatt. Our Amended and Restated Certificate of Incorporation and Amended and Restated Bylaws provide that the authorized number of directors may be changed only by resolution of the Board. Prior to the Sunset Date, directors may be removed with or without cause only by the affirmative vote of the holders of a majority in voting power of our common stock then entitled to vote at an election of directors. After the Sunset Date, directors may be removed only for cause by the affirmative vote of the holders of a majority in voting power of our common stock then entitled to vote at an election of directors.

Director Independence

Our Board has determined that each of Jené Elzie, William Landman, Robert Niehaus, William Royan, John Sculley and Jeanine Silberblatt and nominee Imran Khan qualifies as “independent” in accordance with the listing requirements of the New York Stock Exchange (“NYSE”). In making these determinations, our Board reviewed and discussed information provided by the directors and management with regard to each director’s business and personal activities and relationships as they may relate to the Company and our management. There are no family relationships among any of our directors or executive officers.

Executive Sessions

Our non-management directors meet in executive session without management directors or other members of management present on a regularly scheduled basis. We also hold an executive session including only independent directors at least once per year.

Director Candidates

The Nominating and Corporate Governance Committee is primarily responsible for searching for qualified director candidates for election to the Board and filling vacancies on the Board. To facilitate the search process, the Nominating and Corporate Governance Committee may solicit current directors and executives of the Company for the names of potentially qualified candidates or ask directors and executives to pursue their own business contacts for the names of potentially qualified candidates. The Nominating and Corporate Governance Committee may also consult with outside advisors or retain search firms to assist in the search for qualified candidates, or consider director candidates recommended by our stockholders. Once potential candidates are identified, the Nominating and Corporate Governance Committee reviews the backgrounds of those candidates, evaluates candidates’ independence from the Company and potential conflicts of interest and determines if candidates meet the qualifications desired by the Nominating and Corporate Governance Committee for candidates for election as a director.

In evaluating the suitability of individual candidates (both new candidates and current Board members), the Nominating and Corporate Governance Committee, in recommending candidates for election, and the Board, in approving (and, in the case of vacancies, appointing) such candidates, may take into account many factors, including: personal and professional integrity, strong ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; experience as a board member or executive

17

officer of another publicly held company; professional and academic experience relevant to the Company’s industry; leadership skills; experience in finance and accounting and/or executive compensation practices; whether the

15

candidate has the time required for preparation, participation and attendance at Board meetings and committee meetings, if applicable; and geographic background, gender, age and ethnicity. The Nominating & Corporate Governance Committee and the Board are committed to actively seeking out highly qualified women and individuals from minority groups to include in the pool from which new Board candidates are chosen. The Board evaluates each individual in the context of the Board as a whole, with the objective of assembling a group that can best perpetuate the success of the Company’s business. In addition, the Board will consider whether there are potential conflicts of interest with the candidate’s other personal and professional pursuits.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting the names of the recommended individuals, together with appropriate biographical information and background materials, to the Nominating and Corporate Governance Committee, c/o Secretary, Zeta Global Holdings Corp., 3 Park Ave, 33rd Floor, New York, NY 10016. In the event there is a vacancy, and assuming that appropriate biographical and background material has been provided on a timely basis, the Nominating and Corporate Governance Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Communications from Stockholders and other Interested Parties

The Board will give appropriate attention to written communications that are submitted by stockholders and other interested parties, and will respond if and as appropriate. Our Secretary is primarily responsible for monitoring communications from stockholders and other interested parties and for providing copies or summaries to the directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that our Secretary and Chairperson of the Board consider to be important for the directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we tend to receive repetitive or duplicative communications. Stockholders and other interested parties who wish to send communications on any topic to the Chairperson of the Board, the independent or non-management directors, or the Board as a whole, should address such communications to the applicable party or parties in writing: c/o Secretary, Zeta Global Holdings Corp., 3 Park Ave, 33rd Floor, New York, NY 10016.

Board Leadership Structure and Role in Risk Oversight

Our Amended and Restated Bylaws and Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chairperson of the Board and Chief Executive Officer in accordance with its determination that utilizing one or the other structure would be in the best interests of our Company. The Company’s current Board leadership structure comprises a combined Chairperson of the Board and Chief Executive Officer as well as highly qualified, active independent directors. Our Board exercises its judgment in combining or separating the roles of Chairperson of the Board and Chief Executive Officer as it deems appropriate in light of prevailing circumstances. The Board will continue to exercise its judgment on an ongoing basis to determine the optimal Board leadership structure that the Board believes will provide effective leadership, oversight and direction, while optimizing the functioning of both the Board and management and facilitating effective communication between the two. The Board has concluded that the current structure provides a well-functioning and effective balance between strong Company leadership and appropriate safeguards and oversight by independent directors.

Risk assessment and oversight are an integral part of our governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include a focused discussion and analysis of the risks facing us. Throughout the year, senior management reviews these risks with the Board at regular Board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.

18

Our Board is responsible for overseeing our risk management process. Our Board focuses on our general risk management strategy, the most significant risks facing us, and oversees the implementation of risk mitigation

16

strategies by management and for overseeing management of regulatory risks. Our Audit Committee is responsible for discussing our policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which our exposure to risk is handled, and for overseeing financial and cybersecurity risks. Our Nominating and Corporate Governance Committee manages risks associated with the independence of our Board and potential conflicts of interest. Our Compensation Committee is responsible for overseeing the management of risks relating to the Company’s executive compensation plans and arrangements. The Board does not believe that its role in the oversight of our risks affects the Board’s leadership structure.

Code of Ethics and Conduct

We have a written Code of Ethics and Conduct that applies to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and agents and representatives. We have posted a current copy of the Code of and Ethics and Conduct on our website, www.investors.zetaglobal.com, in the “Governance” section under “Governance Documents.” The nominating and corporate governance committee of our Board is responsible for overseeing our code of ethics and conduct and any waivers applicable to any director, executive officer or employee. We intend to disclose any future amendments to certain provisions of our code of ethics and conduct, or waivers of such provisions applicable to our directors, officers and employees, including our principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and agents and representatives, on our website identified above or in public filings within four business days. In addition, we intend to post on our website all disclosures that are required by law or the rules of the NYSE concerning any amendments to, or waivers from, any provision of the Code of Ethics and Conduct.

Anti-Hedging Policy

Our Board has adopted an Insider Trading Compliance Policy, which applies to all of our directors, officers and employees. The policy prohibits our directors, officers and employees and any entities they control from purchasing financial instruments such as prepaid variable forward contracts, equity swaps, collars, and exchange funds, or otherwise engaging in transactions that hedge or offset, or are designed to hedge or offset, any decrease in the market value of the Company’s equity securities.

Attendance by Members of the Board of Directors at Meetings

There were 1110 meetings of the Board during the fiscal year ended December 31, 20222023 and each director attended at least 75% of the aggregate of (i) all meetings of the Board and (ii) all meetings of the committees on which the director served during the period in which he or she served as a director.

Under our Corporate Governance Guidelines, which are available on our website at www.investors.zetaglobal.com, a director is expected to spend the time and effort necessary to properly discharge his or her responsibilities. Accordingly, a director is expected to regularly prepare for and attend meetings of the Board and all committees on which the director sits (including separate meetings of the independent directors), with the understanding that, on occasion, a director may be unable to attend a meeting. A director who is unable to attend a meeting of the Board or a committee of the Board is expected to notify the Chairperson of the Board or the Chair of the appropriate committee in advance of such meeting, and, whenever possible, participate in such meeting via teleconference in the case of an in-person meeting. We do not maintain a formal policy regarding director attendance at the Annual Meeting; however, it is expected that absent compelling circumstances directors will attend. All seven of our directors attended the annual meeting of stockholders in 2023.

19

17

Our Board has established three standing committees—Audit, Compensation and Nominating and Corporate Governance—each of which operates under a written charter that has been approved by our Board.

The members of each of the Board committees and committee Chairpersons are set forth in the following chart.

Name | Audit | Compensation | Nominating and Corporate Governance |

Robert Niehaus | Chairperson | Chairperson | |

William Royan | X | ||

William Landman. | X | X | X |

John Sculley. | Chairperson | ||

Jené Elzie | X | X |

Audit Committee

Our audit committee oversees our accounting and financial reporting process. Among other matters, the audit committee:

The Audit Committee charter is available on our website at www.investors.zetaglobal.com. Our audit committee consists of Robert Niehaus, William Royan and William Landman. Our Board has determined that all members are

20

18

independent under the Listing RulesNYSE listing rules and Rule 10A-3(b)(1) of the Exchange Act. The chair of our audit committee is Robert Niehaus. Our Board has determined that each member is an “audit committee financial expert” as such term is currently defined in Item 407(d)(5) of Regulation S-K. Our Board has also determined that each member of our audit committee can read and understand fundamental consolidated financial statements, in accordance with applicable requirements.

The Audit Committee met fivefour times in 2022.2023.

Compensation Committee

Our Compensation Committee is responsible for assisting the Board in the discharge of its responsibilities relating to the compensation of our executive officers. In fulfilling its purpose, our Compensation Committee has the following principal duties:

The Compensation Committee generally considers the Chief Executive Officer’s recommendations when making decisions regarding the compensation of non-employee directors and executive officers (other than the Chief Executive Officer). Pursuant to the Compensation Committee’s charter, which is available on our website at www.investors.zetaglobal.com, the Compensation Committee has the authority to retain or obtain the advice of compensation consultants, legal counsel and other advisors to assist in carrying out its responsibilities.

The Compensation Committee may delegate its authority under its charter to one or more subcommittees as it deems appropriate from time to time. The Compensation Committee may also delegate to an executive officer the authority to grant equity awards to certain employees and consultants, as further described in its charter and subject to the terms of our equity plans.

Our Compensation Committee consists of Robert Niehaus, Jené Elzie and William Landman. The chair of our compensation committee is Robert Niehaus. Our Board has determined that all members are independent under NYSE’s heightened independence standards for members of a compensation committee and as a “non-employee director” as defined in Rule 16b-3 of the Exchange Act.

The Compensation Committee met twice in 2022.2023.

Nominating and Corporate Governance Committee

Our Nominating and Corporate Governance Committee’s responsibilities include:

1921

The Nominating and Corporate Governance Committee charter is available on our website at www.investors.zetaglobal.com. Our nominating and corporate governance committee consists of John Sculley, Jené Elzie, and William Landman. Our Board has determined that all members are independent under the NYSE listing rules. The chair of our nominating and corporate governance committee is John Sculley. The Nominating and Corporate Governance Committee has the authority to consult with outside advisors or retain search firms to assist in the search for qualified candidates, or consider director candidates recommended by our stockholders.

The Nominating and Corporate Governance Committee met once in 2022.2023.

22

20

Compensation Discussion and Analysis

General

This section discusses the material componentsIn this Compensation Discussion and Analysis (“CD&A”), we provide an overview and analysis of the compensation awarded to or earned by our named executive officers identified in the Summary Compensation Table below (each, an “NEO”) during fiscal 2023, including the elements of our compensation program for NEOs, material compensation decisions made under that program for fiscal 2023 and the material factors considered in making those decisions. For the year ended December 31, 2023, our executive officers who are named in the “2022 Summary Compensation Table” below. In 2022, our “named executive officers”NEOs and their positions were as follows:were:

Executive Summary Compensation Table

The following table sets forth information concerning2023 Performance Highlights and Pay for Performance.

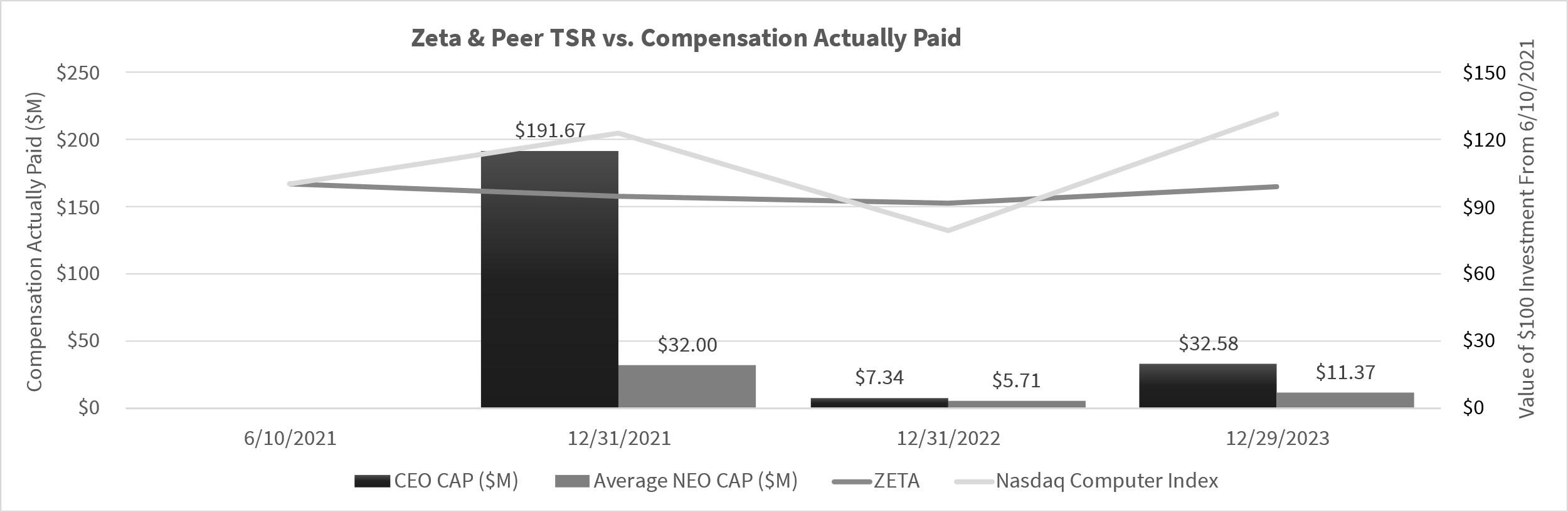

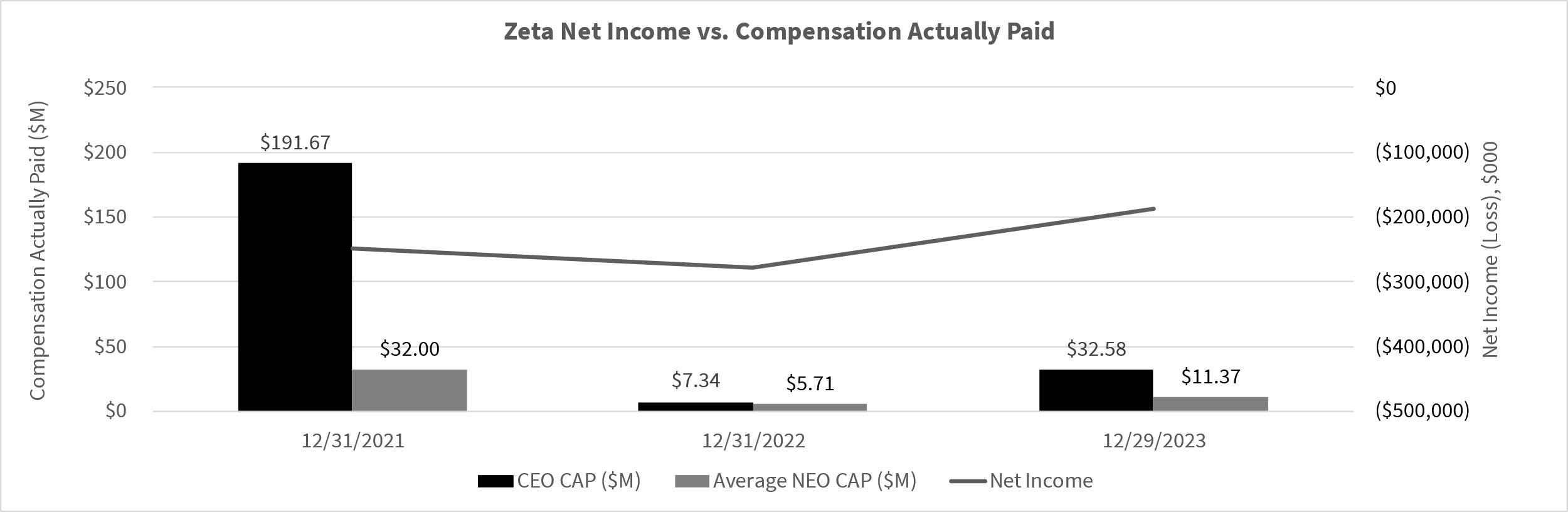

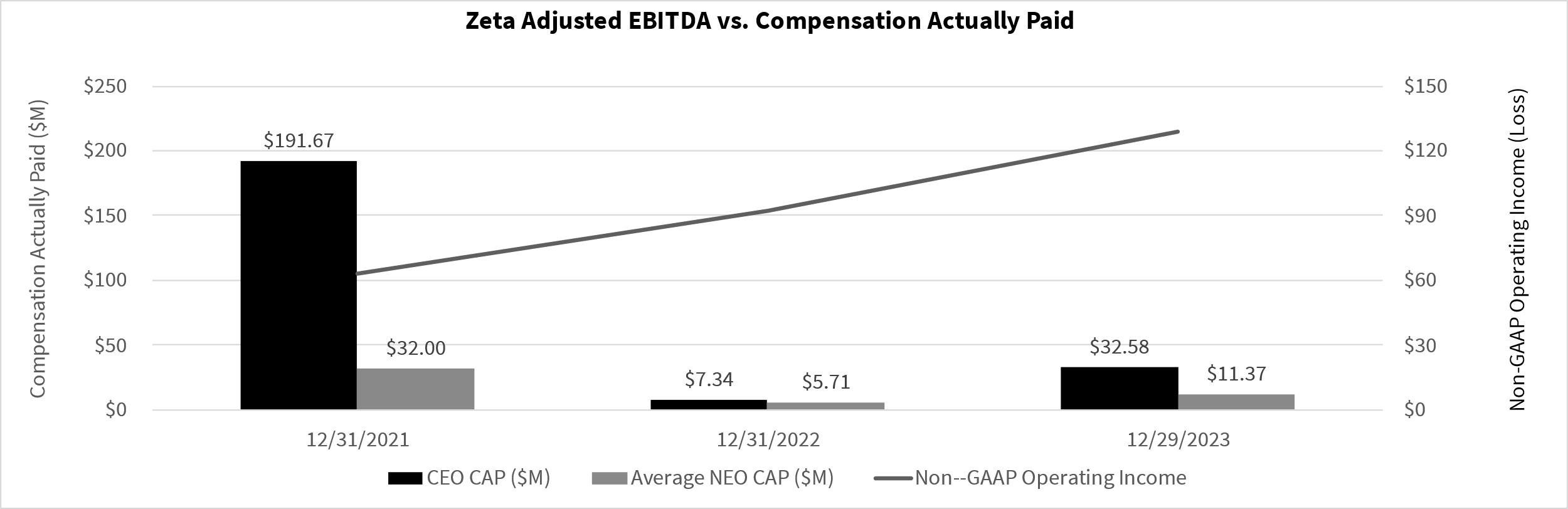

Our executive compensation programs are designed to deliver pay in accordance with corporate and individual performance, rewarding superior performance and providing consequences for underperformance. We believe that the compensation of our named executive officersNEOs for fiscal year 2023 was aligned with the Company’s performance during 2023. Highlights of that performance include:

For additional details and definitions, refer to “Management’s Discussion and Analysis of Financial Condition and Results of Operations” included in our Annual Report on Form 10-K for the year ended December 31, 2023 that accompanies this Proxy Statement.

Name and Principal Position | Year | Salary ($) | Bonus ($)(4) | Stock Awards ($)(1) | Non-Equity Incentive Plan Compensation ($)(2) | All Other Compensation ($)(3) | Total ($) |

David Steinberg | 2022 | $750,000 | $475,000 | $18,336,846 | $ 750,000 | $415,657 | $20,727,503 |

Chairman and Chief Executive Officer | 2021 | $750,000 | $675,000 | $213,985,907 | $ 750,000 | $293,550 | $216,454,457 |

Christopher Greiner | 2022 | $500,000 | $350,000 | $7,134,878 | $ 500,000 | $4,575 | $8,489,453 |

Chief Financial Officer | 2021 | $500,000 | $250,000 | $22,822,319 | $ 500,000 | $59,350 | $24,131,669 |

Steven Gerber | 2022 | $550,000 | $350,250 | $8,725,848 | $ 500,500 | $19,575 | $10,146,173 |

President and Chief Operating Officer | 2021 | $550,000 | $600,000 | $34,673,319 | $ 500,000 | $4,350 | $36,327,669 |

_____________________In order to align pay with performance, a significant portion of our NEOs’ compensation is delivered in the form of equity awards and annual cash incentives, each of which depends on our actual performance. For fiscal year 2023, over 90% of our NEOs’ total compensation was awarded in the form of restricted stock awards, performance-based restricted stock units (“PSUs”) and annual cash incentives.

2023 Compensation Highlights.

Consistent with our compensation philosophy, key compensation decisions for 2023 included the following:

23

Compensation Governance and Best Practices.